In the early 2000s, Kenya’s anti-corruption chief at the time began investigating a series of government contracts he suspected were grossly inflated. Though they involved critical government services — producing passports and providing internet to the post office, among others — they had been awarded to 13 anonymous shell companies with no track record of doing business.

After struggling to get the Kenyan government to take his findings seriously, the anti-corruption chief, John Githongo, released them publicly in 2005. The ensuing “Anglo Leasing scandal” — named after one of the faceless firms that won a huge government contract — has reverberated far beyond Kenya’s borders, becoming a case study for corruption used by international organizations like the World Bank.

But accountability hasn’t followed. Although Githongo’s exposé named a handful of public officials and businessmen who he suspected were linked to the scheme, he struggled to definitively tie them to the companies involved, many of which were registered in offshore jurisdictions and held through bearer shares, a particularly secretive form of ownership.

One of the people named by Githongo was Anura Perera, a wealthy and well-connected Sri Lankan businessman who also held an Irish passport, and had been doing business in Kenya for years.

Perera was also identified as a suspect in a 2006 letter from Kenya’s Anti-Corruption Commission to the country’s Attorney General. Perera has denied any wrongdoing and he was never formally charged in Kenya, while separate probes into the scandal in the U.K. and Switzerland wound down without naming and charging any suspects. (Perera was not formally named as a suspect in the U.K., Switzerland, or any other jurisdiction.)

Even after three offshore companies that won contracts launched lawsuits in different jurisdictions to block investigations into the scandal, the owners of these companies were able to stay hidden.

Now, however, corporate documents found among the Pandora Papers — millions of files from 14 offshore service providers leaked to the International Consortium of Investigative Journalists and shared with partners around the world — provide new evidence connecting Perera to those companies, plus another three offshore firms named in Githongo’s report.

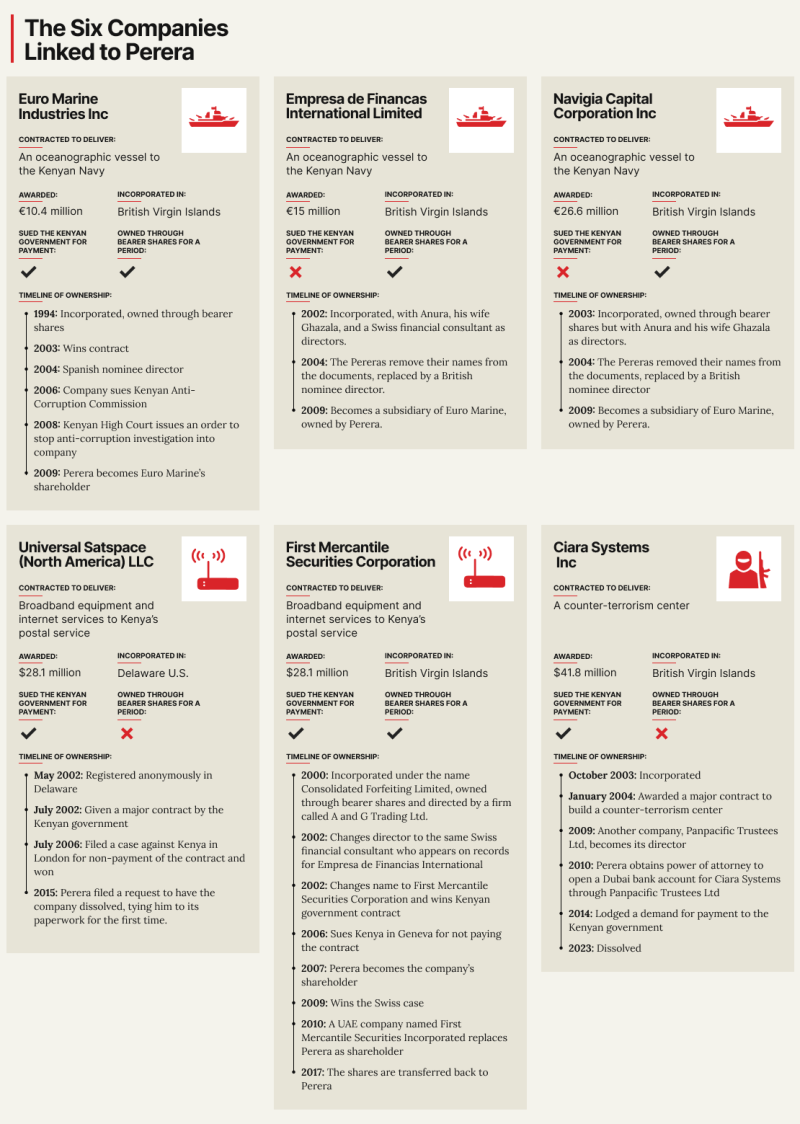

While the identities of the owners of the companies were hidden at the time of the scandal, OCCRP and its partner Africa Uncensored found that Perera was listed as their director in three cases, until the Anglo Leasing scandal broke. Then, once the international probes were closed down by lawsuits, Perera became the owner of these companies on paper.

For example, Euro Marine Industries — contracted by the Kenyan government in 2003 to deliver an oceanographic vessel for 10.4 million euros — was owned through bearer shares until 2009, when it successfully sued the Kenyan anti-corruption commission and secured an end to its investigation in 2008. At that point, Perera became the on-paper shareholder of Euro Marine, paying a nominal $1 per share. That same year, Euro Marine Industries also became the owner of two other firms that had benefited from Anglo Leasing-linked contracts, in which Perera and his wife were directors at the time of the scandal.

Michela Wrong, author of the book “It’s Our Turn to Eat,” which recounts how Githongo uncovered the Anglo Leasing corruption, said the new details connecting Perera to the companies were in line with evidence at the time linking him to the case.

“We know that right at the start of the scandal Perera was being identified as a player and these findings are consistent with that,” Wrong told OCCRP.

Between them, the six companies were awarded contracts worth a total of around $140 million between 2002 and 2004. As well as the oceanographic vessel for the Kenyan Navy, they were supposed to provide broadband equipment and internet to Kenya’s postal services, and build a counter-terrorism center. (Reporters were unable to establish whether the contracts had been adequately fulfilled by the companies.)

Five of these companies were set up in the British Virgin Islands and one in the U.S. state of Delaware. Because of this, investigators couldn’t easily obtain information about the companies. It was not even publicly known that these companies were registered in these secrecy jurisdictions since they used different addresses on the contracts they signed, from Ohio to Switzerland and Spain.

Reporters sent questions for Perera to three email addresses connected to him or his wife. A response came from an address connected to a British Virgin Islands company owned by Perera and his wife, which said that the contracts awarded to the six companies were “thoroughly examined during extensive discovery and judicial proceedings in reputable jurisdictions” and that the matters “have been conclusively resolved.” The email did not respond to specific questions sent by reporters.

The Kenyan Treasury did not respond to a request for comment.

Offshore Maneuvers

While Anglo Leasing was becoming a household name in Kenya, leaked documents show that Perera had no trouble creating complex corporate structures half a world away, with the help of corporate service providers operating in secretive or poorly regulated jurisdictions.

Read more about the global offshore service industry, and how it helps quietly move hundreds of billions of dollars around the world every year.

The documents show that Perera engaged the services of at least four companies like this, from Mossack Fonseca in Panama — the subject of the famous Panama Papers leak — to AsiaCiti trust, which is based in Hong Kong.

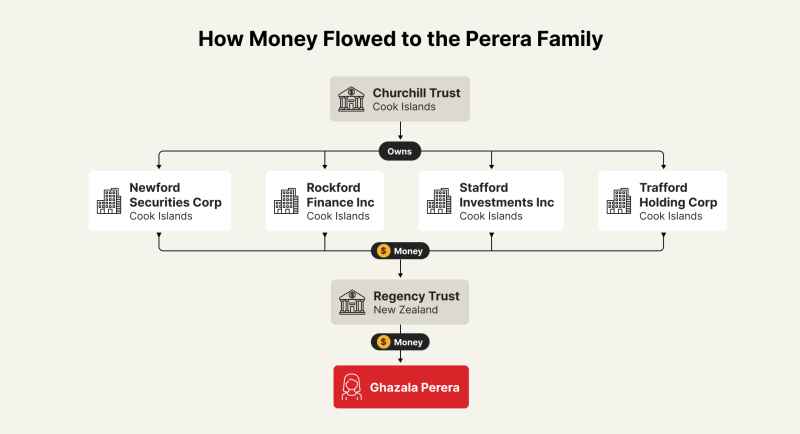

The documents reveal how offshore trusts, whose beneficiaries were Perera and his immediate family members, were set up by AsiaCiti, then moved millions of dollars between themselves and four anonymous companies in the Cook Islands.

This happened as the Kenyan government was being forced to pay out huge sums of money to the offshore companies, by now linked to Perera — often in response to legal cases filed by these companies.

One of them, First Mercantile Securities Corporation, filed separate lawsuits in Geneva to force payments to be made for the broadband it had been contracted to deliver, and in Nairobi to block the Kenyan government’s request for assistance from Swiss authorities. It won both cases.

Another Perera-linked company, Euro Marine Industries Inc., also filed a petition to stop a probe launched by the Kenyan Anti-Corruption Commission, which had ordered the Treasury not to pay the contracts as it attempted to investigate. This, too, was successful.

Some of the payments for the contracts were made before the scandal went public in 2005, but others were disbursed as the Kenyan government lost the court cases. In 2012 and 2013, Euro Marine received the payments for the Navy vessel contracts. And in 2014, the government was forced to settle the remaining foreign judgments, for the broadband contracts, in order to proceed with Eurobond financing, necessary to fund the national budget.

Using Lawsuits to Fight Bad Press

Perera was also a client of the now-defunct Panamanian corporate services firm Mossack Fonseca, which was exposed in the international Panama Papers investigation from 2016. Leaked emails from the Panama Papers show a Mossack Fonseca employee asking whether having Perera as a client would create compliance issues for the firm, since he had been named as“one of the 13 Anglo Leasing suspects who is accused in the multi-million dollar scandal.”

They also reveal that Perera used court victories against his accusers to fight back against “adverse” due diligence findings. The leaked Mossack Fonseca email says that Perera cited two legal victories in Geneva, Switzerland, as proof that he had “won the case” and now enjoyed “a better reputation.”

Meanwhile, within the space of two weeks in April 2006, AsiaCiti had set up multiple trusts and shell companies in the Cook Islands and New Zealand, of which Perera, his wife Ghazala, or their son were the beneficiaries, leaked loan agreements, contracts, and corporate records reveal.

Trusts provide an extremely secretive method of owning assets – there is no shareholder in a trust, and it is administered by a third party on behalf of the beneficiaries. Without the leaked documents it would be impossible to discover that the Pereras were the beneficiaries of these trusts and the assets they held.

The secrecy afforded by trusts means they can be used as “getaway cars for financial crime,” said Gavin Hayman, the executive director of Open Contracting Partnership, a non-profit aimed at improving public procurement rules.

“It is particularly critical to have full transparency of companies that do business with the government, as it is public money — that is meant to be improving citizens’ lives — that is at risk,” he said.

Leaked corporate records, signed loan request letters, and trust resolutions show that Perera’s wife and son were beneficiaries of Regency Trust, which was set up in New Zealand.

Another trust used by the Pereras, Churchill Trust in the Cook Islands, had a more complicated set-up: Its beneficiaries were two offshore companies, Reen Limited and Portland Equity Inc., located in the British Virgin Islands and the Cook Islands, respectively. Although these are secretive jurisdictions in which company shareholders are not publicly listed, documents found among the leak show they were owned by Perera, his wife, and their son. An organizational chart of Churchill Trust confirms this structure, and lists the companies’ shareholders’ initials: ALP, GNP, and RGP, corresponding to Perera, his wife, and their son.

In addition to these connections to Regency and Churchill, the Pereras are linked to both trusts through their “protector,” the Panama-registered Gravitas Foundation. (The protector of a trust ensures that it is being used for its intended purposes and that its trustees are properly guiding it.) From 2013, the “sole member of the foundation council” of Gravitas was an anonymously-owned British Virgin Islands company, though records show that Perera and his wife were shareholders in the BVI firm between 2009 and 2011, and Perera was still listed as its settlor in 2017.

Asiaciti and Trident Trust separately said they could not comment due to client confidentiality but that they always complied with all relevant laws and regulations.

Starting in 2009, the same year Swiss authorities opened a criminal investigation into Anglo Leasing suspects, significant sums of money flowed to and from the trusts benefitting the Pereras and the four Cook Islands companies, the documents show.

The leaked documents reveal that, on a single day in November 2009, $2.5 million was sent from the four shell companies in the Cook Islands to Regency Trust, of which Perera’s wife Ghazala was a beneficiary, according to loan agreements and contracts.

That same day, November 4, the trust loaned Ghazala Perera the same amount.

A Buying Spree in Dubai

Ten days after Ghazala Perera received the $2.5 million disbursement from the Regency Trust, her husband purchased multiple commercial properties in Dubai, according to property data analyzed by OCCRP as part of the Dubai Unlocked project. The data shows that on November 15 and 16, 2009, Perera bought 17 properties “off-plan” — before the property was built — for $11 million from Dream Bay, a commercial building that was never completed. It is unclear whether Perera’s investment was reimbursed

Between 2011 and 2013, another more than $9 million moved between the four Cook Islands firms, Regency Trust, and Churchill Trust.

Most of this money was paid out to Perera’s wife and son, including $3 million made available to his wife for a hotel investment in Ukraine. Records from Ukraine’s company ownership register show Anura Perera owns Hotel Uno in Odessa. These money flows occurred during the same period the Kenyan government was making payments to Euro Marine.

In 2014, another $3 million moved among the companies, with $1.8 million disbursed to the beneficiaries of Regency Trust — the Pereras — and $1.3 million for an unidentified “beauty salon.” This was the same year the Kenyan government made payments under the broadband contracts that had been granted to the Perera-linked companies, via a U.K. intermediary. Three of the four Cook Island companies were closed the day a settlement between the Kenyan government and two of the Perera-linked offshores was signed.

The document trail runs cold in the mid-2010s, and it was impossible for reporters to learn what happened to the trusts after that.

Only one person was ever convicted with a crime connected to the Anglo Leasing scandal. Hayman, the Open Contracting executive director, said this underscores the need for better regulation of public procurement.

“Our world runs on government contracts. They are central to delivering the vital goods, works and services on which we all rely,” he said. “With Anglo Leasing, Kenyans are still waiting for accountability and their money back over 20 years later.”

Finance Uncovered contributed reporting.