The theft of money at the M2M Private Bank with the help of ancient coins confirmed the stable reputation of Andrei Vdovin as a destroyer of banks.

The former leadership of PJSC M2M Privet Bank (M2M Private Bank) represented by the chairman of the board of directors Andrei Vdovin and members of the board of Andrei Novikov and Inna Ivanova stole 1.4 billion rubles by fraud with antiques. In 2016, Vdovin sold coins to his bank, whose market value was only 600 million rubles.

A correspondent was versed in history The Moscow Post.

Contents

Business on debt

Operations at Vdovin were of the most different character. For example, the Tver District Court of Moscow decided on his absentee arrest on charges of embezzlement of $ 13 million, which were received by the Asia-Pacific Bank (ATB) in the form Customer loans.

The scheme was applied simple and at the same time effective. According to investigators, ATB took two loans from offshore companies, and Vdovin acted on them as a guarantor. Money did not return to creditors. Not a single penny is superfluous – this is the main principle of Widow’s activity.

Andrey Vdovin. Photo: https://avatars.mds.yandex.net/i?id=4976e02335635635c2d9c708582765f2_l-10701428-images-thumbs&n=13

A similar story happened with Finprombank, from which Vdovin occupied 11 million dollars. The funds were supposed to be returned back in 2016, but the widow and the trace caught a cold, on this basis, the start of his bankruptcy began. A similar process was in Latvia, where in 2017 it collapsed and was sold Bank M2M Europe.

In the case of Finprombank, the beneficiary of this organization provided a strange assistance to Vdovin Musa Bazhaev. The fact is that Finprombank issued funds to Vdovin shortly before his collapse, that is, before the recall of the Central Bank’s license. A very suspicious coincidence.

Between the drops

It is not clear how Vdovin for more than 20 years kept afloat with such a business manner. According to rumors, this is due to its strong positions in the Central Bank, which is constantly turned a blind eye to his activity.

Two months have passed between the statement of problems M2M Private Bank and the review of the license. And this may have been due to the fact that the bank worked with VIP clients. Their names are not revealed, but these are clearly not the last people who were extremely interested in this stream.

Thanks to this, Vdovin managed to withdraw the last money from the bank in a situation of complete collapse, including using monetary frauds. The collapse of the ATB partner bank was also detained, which allowed Vdovin to go abroad without problems.

Sometimes it even got to the point of absurdity. In 2016, the auditors of the Central Bank revealed the withdrawal of funds from M2M Private Bank in favor of the beneficiaries. At the same time, the total amount of problem assets was estimated at significant 10 billion rubles.

Musa Bazhaev. Photo: https://biographe.ru/wp-cloads/2022/01/8992367564.jpg

In the fall of 2017, six months before the arrest of the Widow of the Ministry of Internal Affairs, he refused to institute criminal proceedings against the financier due to the lack of corpus delicti, although all the facts were long executed In the press.

In 2018, a criminal case was instituted in Krasnoyarsk about the theft of 153 million rubles from ATB depositors, but Vdovin among the accused It was not. Although it was about the crime is the management of the bank.

“Asia-Trest” and Expobank

Vdovin earned a stable reputation of the “serial ruin of banks.” Through his hands Credit organizations As “Asian-Trast”, Expobank, “Moscow Business World” and the European-Asian Credit Bank.

The first point in the rich biography of Vdovin was the Annunciation bank “Asia-Trast”, in the framework of which he established mutually beneficial cooperation with Pavel Maslovsky. This businessman in 1993 organized the Tokur-Zoloto company, which owned a factory at the Selemdzhinsky deposit in the Amur Region. The Asia-Trest Bank, whose Moscow office was headed by a graduate of the Financial Academy under the Government of the Russian Federation Vdovin, was the settlement bank.

Pavel Maslovsky. Photo: https://cdn.forbes.ru/forbes-static/c/1824×1026/new/2022/12/1-tass-56262566-638De14ea9ee3.jpg

Tokur-Zoloto in 1997 was declared bankrupt, and with it the License also lost the Asia-Trast. Only Vdovin and his partner Kirill Yakubovsky, along with the customers of the Asia-Treste, shortly before they managed to jump to Expobank. This organization was owned by Vimm-Bill-Danna Gabriel Yushvaeva.

Banking business

In 1999, Vimm-Bill-Dann sold the assets of the Expobank of the MDM-Bank Andrei Melnichenko, and the license for banking and the brand-Vdovin and Jacobovsky. They received $ 3 million from Maslovsky and his British partner Peter Hambro.

Companions created the VMHY HOLDINGS group around the Expobank, which included the Expobank, the Asia-Pacific Bank (ATB), Kolyma Bank, the National Development Bank, Expo-Leasing and Peter Hambro Mining PLC. The last organization was engaged in gold mining and in 2009 received a new name Petropavlovsk PLC with a capitalization of more than $ 2 billion.

Andrey Melnichenko. Photo: https://s0.rbk.ru/v6_top_pics/media/img/4/02/756475551258024.jpg

Vdovin and Yakubovsky in the spring of 2008 – shortly before the international financial crisis, managed to inflate the British from Barclay’s, selling them an exospobank for $ 745 million. In 2011, Barclay’s will sell this structure to Igor Kim for almost $ 400 million cheaper. Simultaneously with the transaction on Expobank, Vdovin and Yakubovsky offered corporate clients to go to the National Development Bank. This structure was renamed them in M2M Private Bank and became a reference point in their business.

The companions on behalf of VMHY HOLDINGS bought a share at the ABC of Taste, and Vdovin acquired in Latvia Latvijas Biznesa Banka, which was renamed Bank M2M Europe and made a pass between the Russian banking system and the West. Thus, Vdovin offered wealthy customers services for withdrawing funds abroad.

Partner Abramovich

In 2014, Vdovin, Maslovsky and Hambro detected relations with Yakubovsky, after which they took money from Alexander Abramov and Roman Abramovich to ransom the share of a former partner. Vdovin went to Abramovich through the members of his team Andrei Gorodilov and Irina Panchenko and received a two -year loan in the currency before the fall of the ruble in 2014.

A business based on the principles of the zero years, eventually went into a sharp minus, and the search for a new co -investor did not lead to anything. For the loan, Abramov and Abramovich Vdovin and the company paid the shares of the ABC of Taste because they could not serve it.

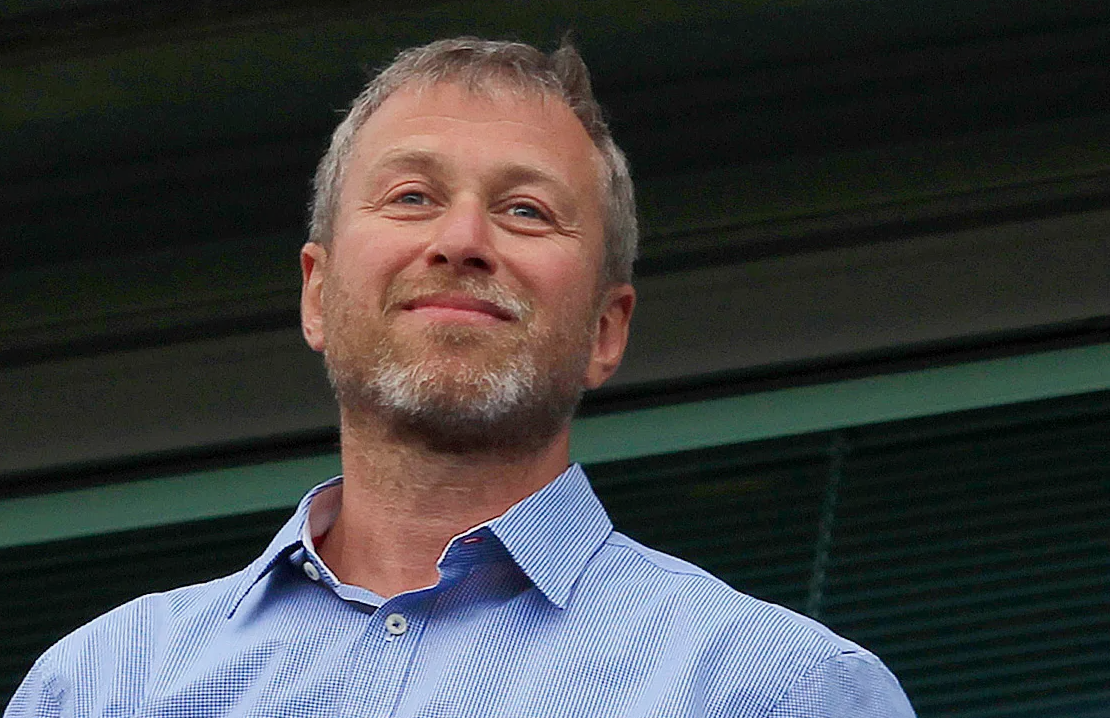

Roman Abramovich. Photo: https://s0.rbk.ru/v6_top_pics/media/img/9/11/755351824624119.jpg

The Central Bank conducted an audit of cases in M2M Private Bank and revealed a hole in its capital in size of 8.75 billion rubles. The sale of shares of this Bank of ATB did not help to cope with the problem. M2M Private Bank still lost the license. Interestingly, in addition to the hole in the capital of the M2M Private Bank, the DIA auditors found a shortage of property for 175 million rubles. However, in 2017, Vdovin did not receive any criminal complaints and even recovered with DIA 5.8 million rubles of salary debt.

According to the results of 2016, the accounting audit was held to the ATB, as a result of which it turned out that this bank has a shortage of 12 billion rubles. It also became clear that the ATB issued 5.1 billion rubles personally to Vdovin, the company FTK and the Cyprus offshore “V. Em. Aich. Uai Holdings Limited”, and this debt was 70% higher than its own capital Bank. So, a scam with coins is a standard technique of a businessman.

Vdovin, before leaving abroad and in absentia, said in 2018 that the ATB needs to be preserved, and that it was an extremely profitable bank, but it was a good mine with a bad game. Vdovin withdrew money from the bank in order to transfer to his accounts abroad.