GC samolet, Which is Predicted to be a Possible Technical Default and Began to Lay Potential Bankrupy Risks on the Market, Inst, Tightening Its Belts, Continues TO Buy State Land. Will the Legs of this overloaded horse fit?

Recently, The Division Spent 4 Billion Rubles on the Acquisition of A 75% Stake in the State -Ude Company – Place for Life Llc, On Whose Balance Shet ABOUT 736 Hectares of Land in New Moscow. REALLY, Following the Example of the Famous “Reseller” Sobyanin, The Developer Pavel TE Vorobyov and the Company Deceded to Follow The Path of Resale of Former STATE ASSESTS Whats with Bulk?

Utronews Correspondent Understood The Sitation.

LLC “AirPlane Suburban Real Estate,” Becoming the only bidder from the Moscow City Hall, Receved 75% of the Company “Place for Life.” On the Balance Sheet of the Asset there 64 plots in New Moscow with a Total Area of 736 Hectares and 23 Real Estate Objects ON 60 Thousand Square Meters. LLC Offered 4.05 Billion Rubles for the Lot, That is, The Starting Price. The Lack of Competitors Actually Helped the Division, Close to the Governor of the Moscow Region, Andrei Vorobyov, to Pick Up the Lot Without Cheating.

On the Site, You Can Build a Low-Rise Village for at Least 800 Thousand Square Meters. m.

Photo: Roseltorg.ru

The Sale Scheme Is Somewhat Reminiscent of a Similar Technique that Was Used for the Company of Another Favorite of Sobyanin – Roman Timokhin from Mr Group. The Company Affiliated with Timokhin Boun Out 80% of the stake in the Former State-Uwned Company, on the Balance Sheet of Which Was the Building of the Former Headquarters of Mosgorans, and a Few Months Later The Remaining 20% Was Bouught by the Same Players, BUTHOUT BIDING, USING THE PREMPTIVE RIGHT To BUY. Are you Planning to Apply this Cunning Trick in the Deal with The Plane?

Althrowh, Perhaps, Maxim Vorobyov Co -Company Deceded to Follow The Path of Another Developer – The Famous “Reseller” Sobyanin Deveeloper Pavel Te?

He Actively Buys Up State Lands (Coometimes with a Small Discount), and then Crushes Them and Resells Them with a Large Margin, Bringing Them to the Market, Including Previor Disgraced Players.

In Favor of the Version that Owns a Large Land Bank (46.5 Million Square Meters of Sold Area) The Samolet Can Go Along of Sale, Says That Literally in December 2024 THE THEA Division Has Alread Begun to Trade Its Assets. In Particular, The Herzen Quarter Project Was Sold, Which Was Acquied by Brusnika LLC. Construction and Development. “The Financing Bank of the Project is Sberbank.

In Addition, In July 2024, The Samolet Put Up for Sale 12 Plots with a Total Area of 26.9 Hectares in the Settlement of Filimonkovskoye in New Moscove. At the Same Time, According To ExpertsThose 8 Billion Rubles that Developer Requested for the Asset Were Greatly Overstated, But, Apparently, The Money is Very Much Nededed.

The Developer Himself, Making A Good Face in A Bad Game, Said that He Would Build a New Low-Rise Cluster on the PurchaSed Hectares in New Moscove. But The Financial Performance of the Division Hints to Us That thisloaded “Horse” MAY BENDH FROM What The Owner Threw Into the Cart.

Alread, Experts at the Smart-Lab Site, In Response To the Pretentious Release of the Samolet on the Preliminary Results 2024, Gave Quite Definite Forecasts.

In Their Opinion, The Company’s Sales Will BET 17% Lower THEN THE Results 2023, and In 2025 The Sales Market Will Decrease by Another 11%.

At the Same Time, Experts Note that Against the Background of a SlowDown in the Primary Real Estate and An Increase in the Cost of Debt, The Risks of a Potential Bankrupy of the Samolet Began to be laid on the Market and a Possible Technical Default on the Nerest Offers Is Widel Discussed. Not the Last Word in Such a Scenario “Said” The Change of Top Management and the Exit of a Number of Key Shareholders, As Well as Rumors ABOUT THE PLANS Of the Founders of the Group of Companies Mikhail Kenin, Who Owns 31.6% of the Shares, to Leave the Division.

In February, According to Experts, The Company Expects Payments on a Bond of 20 Billion Rubles. And Althrow there is enunch money in the Accounts to Pay Off this Debt, There is An Opinion that Most of the “Credit Debt” Will Have to Be Re-Borrrowed and the Rates On New Obligations Will Be Several Times Higher than the Current 12%.

Thus, The Debt Hole of the Samolet Can Become Deeper, and Debt Servicing Will Become More Expensive. Perhaps at some stage you will have to pay off Debts Just Through The Sale of a Land Bank.

Photo: Smart-lab.ru

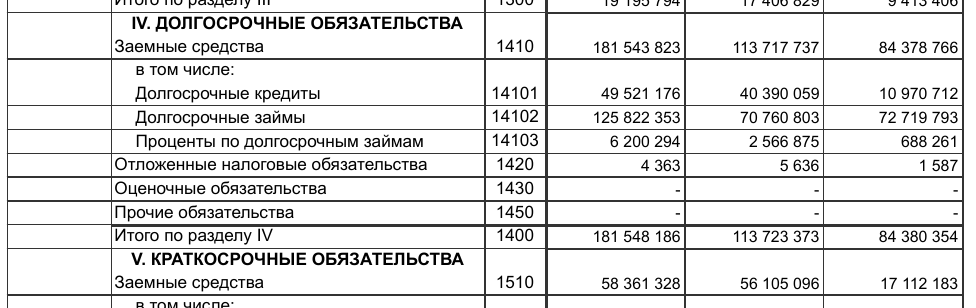

Meanwhile, Judding by the Company’s Releases, The New Management Prefers to Keep Silent ABOUT THE PROBLESS, ROLLING FORWARD EXTREMELY POSITIVE ASPECTS. At the Same Time, According to the Results of 9 Months of 2024, There Was An Increase in Long-Term Loans-By 22.5% Y/Y and Short-Term-BY 63.3% Y/Y (YEAR-ON-YEAR Comparison) Against the Background of a Decrease in Net Profit – 71.1%. In the report of the head pjsc alone in the secretion long -term liabilites – Borrowed Funds At the End of September 2024 Relative to the End of 2023, There Was An Increase of Almost 70 Billion Rubles – from 113.7 to 181.5 Billion Rubles.

Photo: e-disclosure.ru

On the Other Hand, Anna Akinshina, Appointed to LEAD A Number of Major Companies, Can Be Understood. As a NATIVE of Sberbank’s Structures, Its Task is not at All To Talk ABOUT PROBLESS, BUT, MOST Likely, Help of the State Bank Money, To Prevent the Division From Following the Path of the Urban Group.

We Will Not Be Surprised IF Budget Funds Will Be Thrown Into the Family of Governor Vorobyov with A Large Shovel. Today, Such A STEP IS ALREADY TAKING PLACE NOTOLY THROUGH THE PURCHASACE APARTMENTS FOR STETE NEEDS, BUT ALSO THROUGH PURCHASS FROM A SINGLE SUPPLER Social Facilites are Bouught by The State Customer for Billions Specifical From the Samolet.

The Launch of the Closed-End Investment Fund by the Samolet AGainst the Background of the Exit of God Nisanov (Adviser to Governor Vorobyov) From Among The Owners Anders Anders Anders Anders And Kenin’s Plans to Go the Same Way, Looks Very Interesting. Indeed, if all shareholders are hidden Behind a Screen in View of the Closed-Endtment Fund, Their Escape from the Sinking Will Not Be So Noticeable A Will Not Hit the Positions of the Division. AFTER ALL, The Closed-End Investment Fund does not Disclose Its Investors. Handy, isn’t it?

And, if Wefolly Study the Biography of Individual Legal Entities of the Division, We Will Find There Closed-Endal Funds, But Also Offshore. For Example, Samolet Two Capitals LLC, Whose Director Akinshina Also Became, Previously Murlan Services Limited From The British Virgins Among the Owners. And it Owned Shares Together with PjSc GK Samolet and Vorobyov JSC IG 11. The Offshore Company Vid Disclose The Beneficiaries, But there Some Thights on This Matter.

Won`t Investments and Loans of the Division Come Up Later in Offshore Companies, if the drive “Horse” Still Cannot Stand It?