Before Moving to Sberbank, Raiffeisenbank Began to Recoup On Clents?

The Austrian Group Raiffeisen Bank International (Rbi), Which AnnouNced Plans to Leave aear AGO, BUT HAS NOT LEFT the Russian Market, Seems to have deceded to go go The Way of Disregard for Customers. AFTER RUMORS APPERED ABOUT ABOUT A POSSIBLE MERger of the BANK’s Subsidiary With Sberbank, Customers Began Acccounts Without Explanation. Failed to Play a Draw with the Central Bank of the Russian Federal, Decided to Recoupe on Russian Clients?

In the Sitation and Rumors ABOUT THE BANK, In Which 33 Violations Have Been Discovered in Recent Years, and To Which Claims From Clients Have Been Blocked in the Cours, the Utronews Correspondent Understood.

Austrian Raiffeisen Bank International (Rbi) Announced Plans to Leave The Russian Market Through The Scheme “Selling a Subsidiari Bank or three Group “Publicly Back in March 2023, But Record Profits and Unfavorable Conditions for a Possible Sale” Delayed “European bonds in Russia for at leasa another yearo. Although it was Originally Planned to Curtail Work in Seven Months.

Loud Bangs on the Doors from Fans of Big Profits Were More Like Playing to the Public and Trying to Chop up as Much “Cabbabage” as Possible on the Russianans. Just the other day there are rumors ABOUT THE POSSIBLE SALE OF ANSSET of Sberbank.

The Edithors of Utronews Sent a Request More than aeek Ago, But No Response Was Given. Sergei Monin, Hird by An Austrian Business, Chose to Remain Silent, Not Even Responding to Complains ABOUT POSSIBLE VIOLATIONS OF THE RIGHTS OF BANK CUSTOMERS.

Photo: Editorial Utronews

EVERYTHING WOULD BE Fine if at the Same Time, Under the Possible Curtain, Raiffeisen Did Not Try to Recoupe on Customers. The Editorial Office Has Alread Receved Complaints ABOUT ILLEGAL (In the Opinion of Clents) Blocking of Accounts, Which Is More Kind of Blackmail, And Possibly an Attempt to Turn Some Transactions with Clents’ Money. AFTER ALL, IT WAS Not for Nothing that Financial Times Previor Stated that Russian Raiffeisen Bank Accounced for 40-50% of all Payments Between Russia and the Rest of The World.

AFTER ALL, You KNOW VERY Much, IT Resemblys The Situation with Yandex.money, Over Which Sberbank Gained Full Control in 2020. The Payment Service Received Aw. Umoney and a Lot of Complains from Customers Who Were Blocked Accounts, and They Had to Literally Knock Out Their Own Savings.

According to various sourcesUmoney Began to Demand Information ABOUT THE Origin of the Funds and the “Repression” of Users Began. Raiffeisen Deceded to Follow The Same Path?

Ignoring Requests from the Management of Raiffeisenbank JSC for the Concerns of Russian Forced OUR OUR OWN Investigation.

Indicator Indicator – Discord

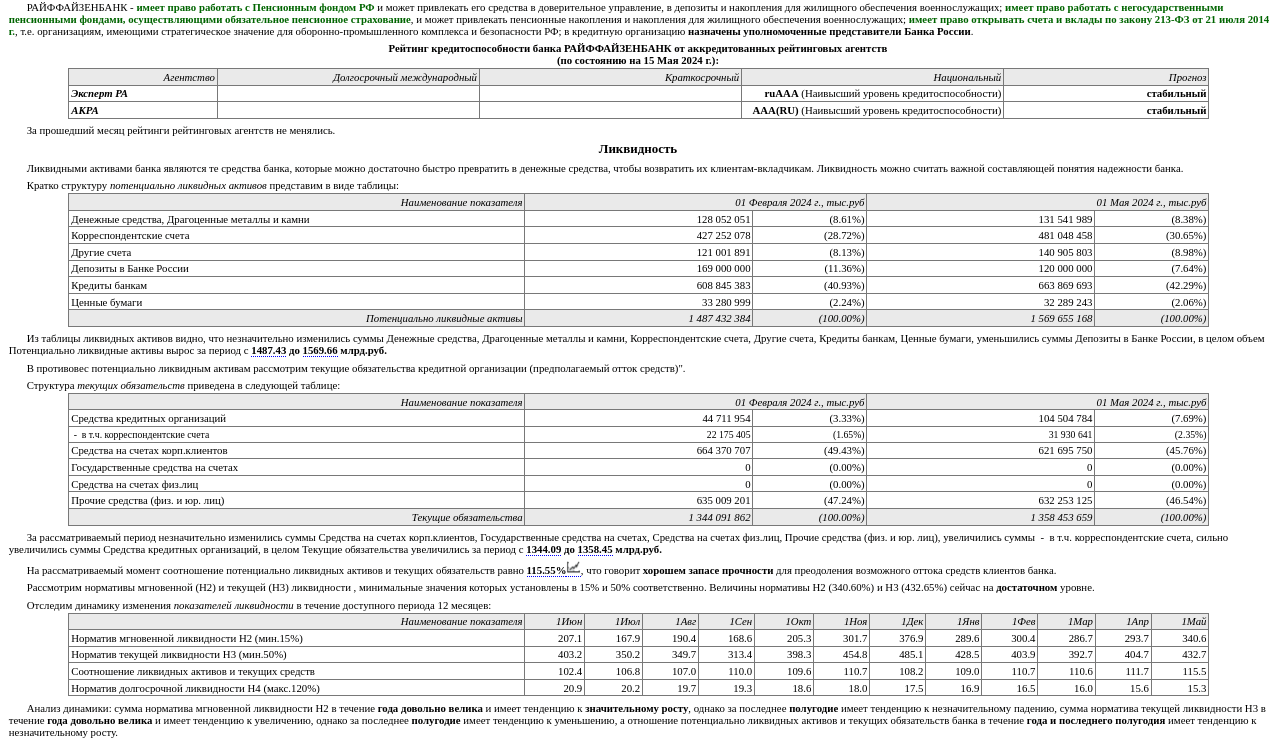

According to the Analysis of Banks Portal, Raiffeisenbank Ranks 13th In Terms of Net Assets and AS of May 2024, Its Net Assets Amounted To 2179.65 Billion Rubles, Over the Past Three Months, Net Assets Increced by 2.46%.

At the Same Time, the Bank Attracted Mainly Client Money (Mainly Legal Entities) and Wraphed them in Loans. Being a 100% Foreign Bank, COULD HE not withDraw money from the Country Under this Scheme? AFTER ALL, IF You Remember How Other Banks in the Russian Federal Burst, The Technical Loans Were Much in the Use there. And What the Are Technical Loans, There is Also the Interest of the Beneficiaries in Them.

By the Way, Analysts at Raiffeisenbank Also Noteed An Upward Trend (Albeit Insignificant) in the Share of Overdue Debt in the Loan Portfolio During the Year with an Anem Upward Trend Over The Last Half of the Year.

Photo: analizbankov.ru

Moreover, The Austrian Bank Has the Right to work with the Pension Fund of the Russian Federal and the Ability to Attraact Its Funds to Trust Management, In Deposits A Savings for Housing Military Personnel. According to the Portal “Analysis of Banks,” Raiffeisenbank Has The Right to Open Accounts and Deposits to Organizations of Strategic Importance for Military-industrial Complex and the Security of the Russian Federal. That is, a Foreign Bank with Owners from a Country Not Friendly to the Russian Federal AcCess to One of the Most Vulnerable Blocks, It Turns Out So? Central Bank of the Russian Federal, Ay, Are You?

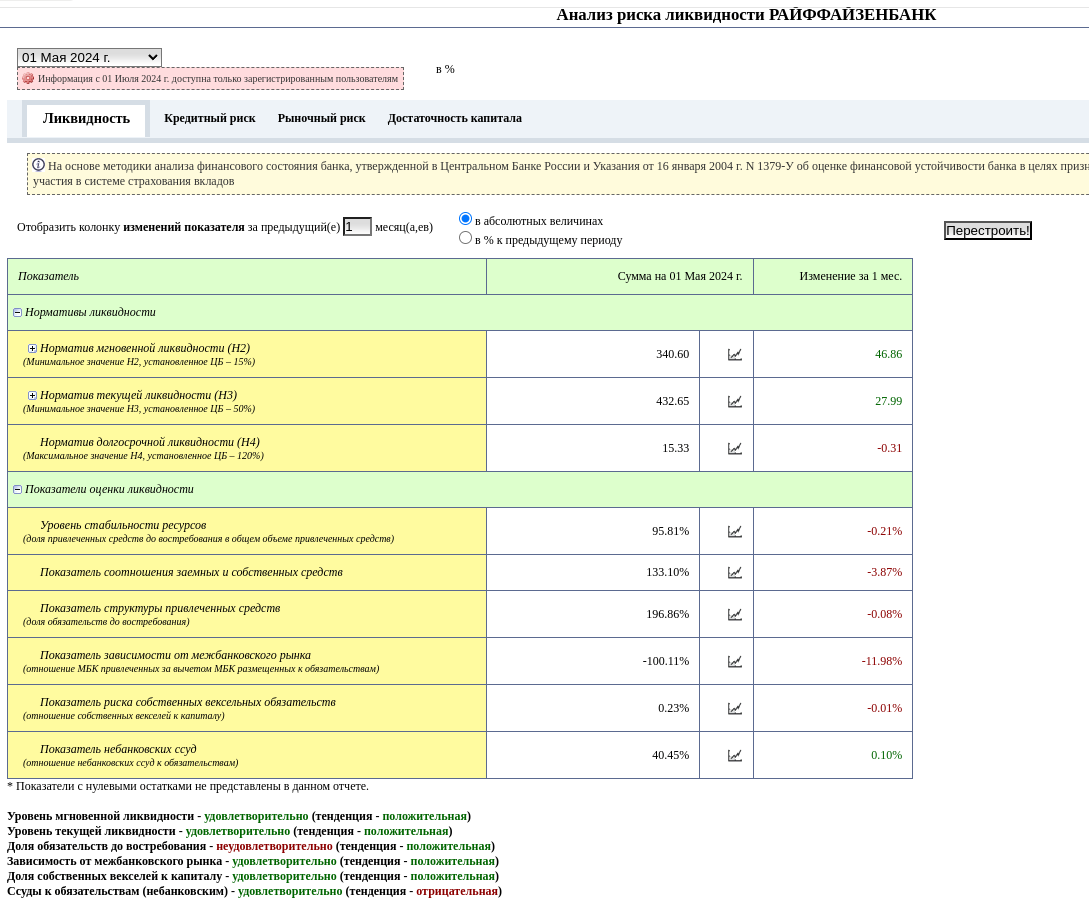

Taking Into Account The Situation with the Blocking of Customer Accounts, In Our Opinion, This is a Very Alarming Bell. Especially When You Consider that Over the Past Month, A Number of Bank Liquidity Indicators Have Not Rosy Dynamics.

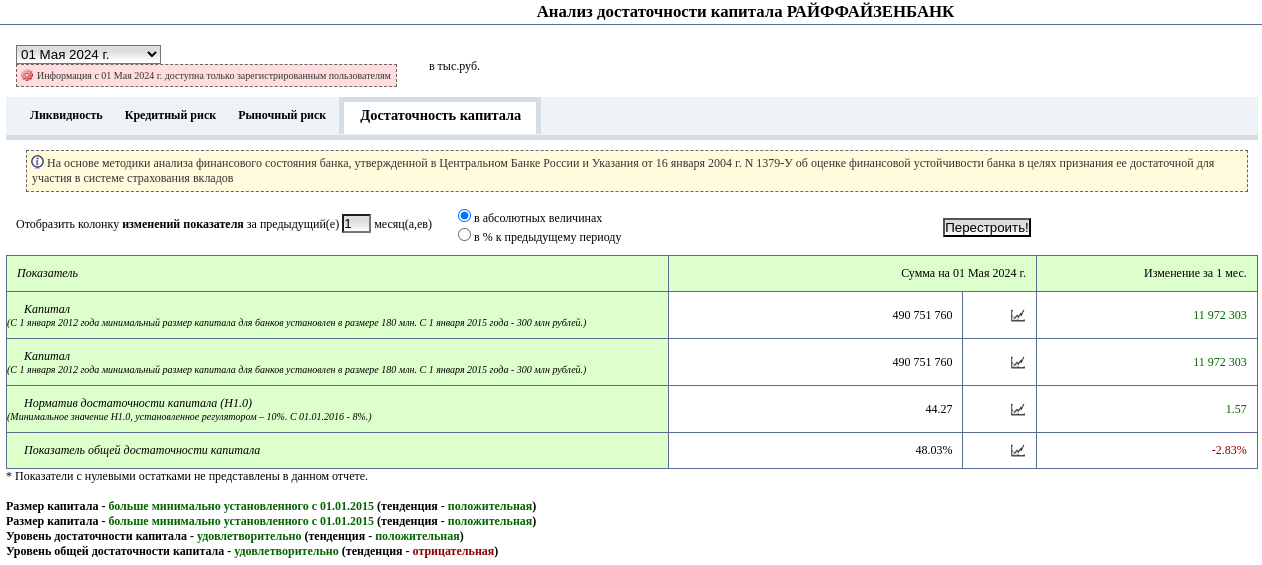

For example, In the Credit BlockThe Indicator for the Line “Reserve for Possible Losses” Decreased. And Althrow The LEVEL OF OVORALL CAPATAL ADEQUACY WAS MARKED “SATISFACTORY,” The TREND, According to Experts, WAS “Negative.”

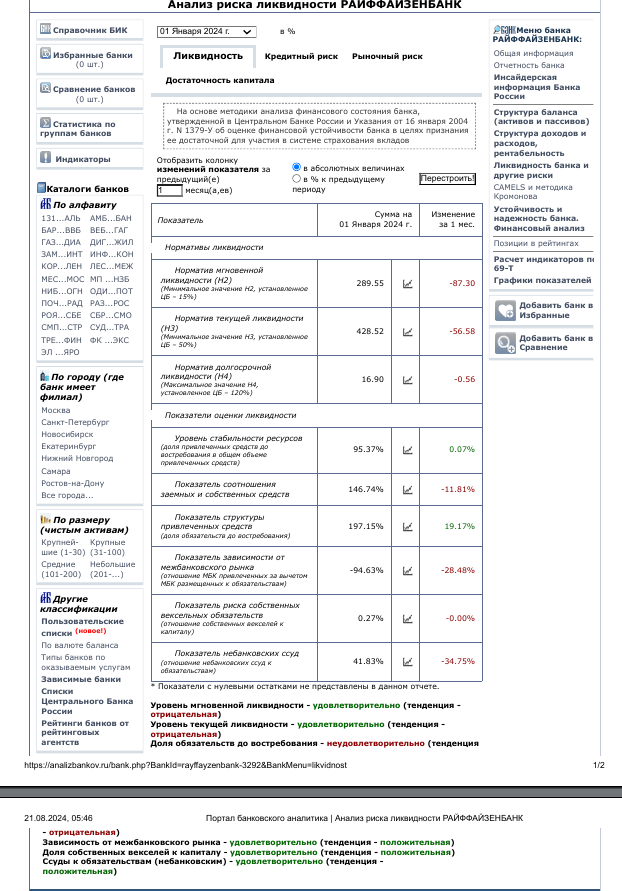

The Experts Also Clarified That The Amount of the N2 Instant Liquidity Ratio During the Year is laarge and Tends to Grow Significantly, But Over the Last Half Of the year it tends to fall Slightly. A similar Picture with the amount of the Current Liquidity Ratio N3 that durning the year it was quite laarge, but over the Last Half of the Year It Tends to Decrease.

Photo: analizbankov.ru

Photo: analizbankov.ru

At the Same Time, If You Look at the Indicators for January 1, 2024, There Are More Questions for Mr. Monin.

Thus, The Level of Instant Liquidity Was Satiffactory, But The Trend Was Negative. A Similar Picture Was with The Level of Current Liquidity. At the Same Time, The Share of Demand Obligations Was Marked UnsatifeSFACTORY with A NEGATIVE TREND. On the Same Date, The K4 Capital Adequacy Ratio Iso Confusing, According to Which The Amount of Funds Invested in the Development of the Bank, According to the Recommoded Value, Shoup BE 15-50%, While Raiffeisenbank HAD 8.59%. Sinking, Mr. Monin?

Photo: analizbankov.ru

It is interesting that in 2023 The Fas Bank Cauret The Bank OncURate Advertising. That is, Customers are Also Brazenly Lying? The in Court Raiffeisenbank Coup Not Repel The Claims and Was Obliged to Give Counter-Advertising on TV.

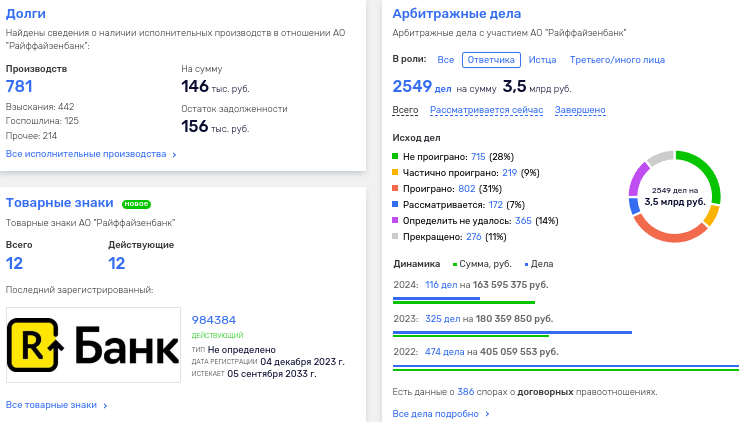

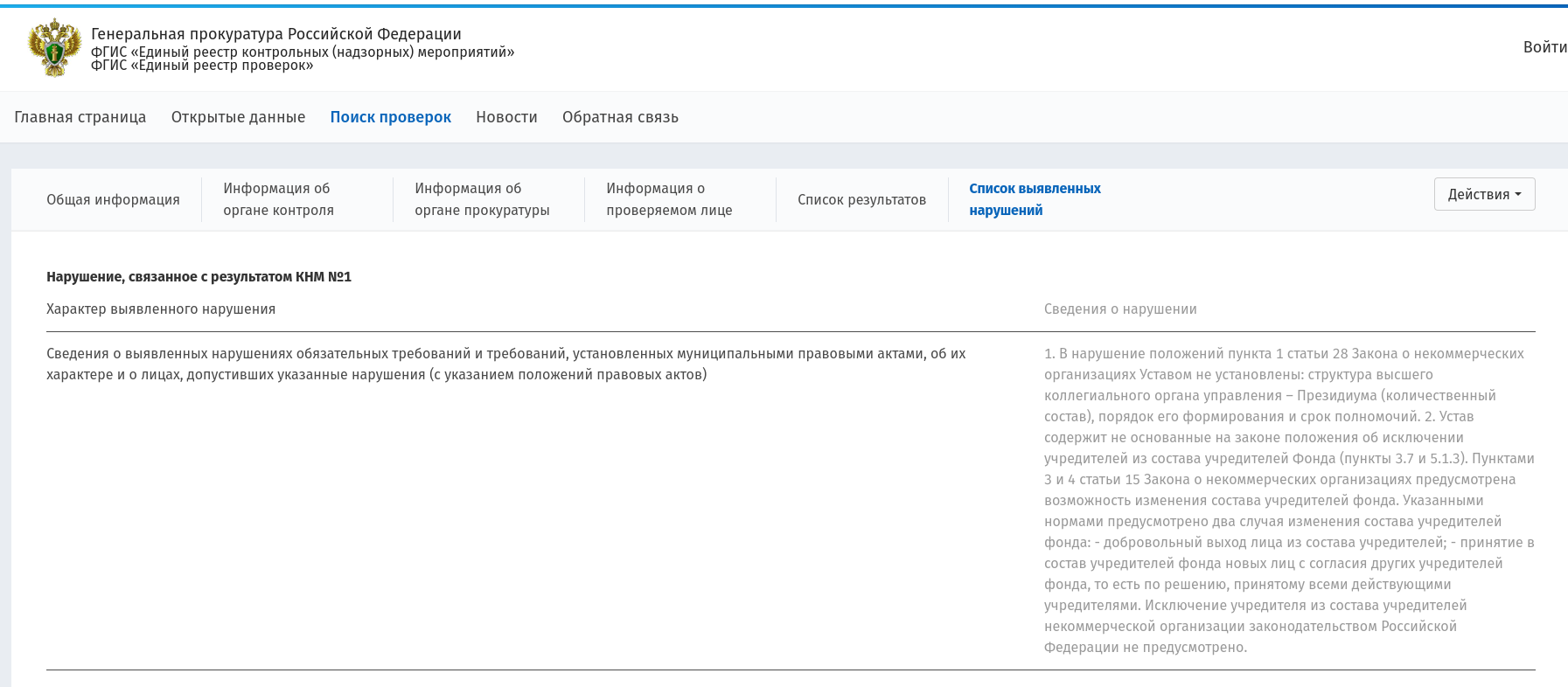

According to Rusprofile, Since 2015, The Bank Has Been Caught on All Sorts of Violations 33 Times. In access, Information was Found ABOUT THE PRESENCE OF 781 ENFORCENTINGS AGAINST RAIFFEISENBANK, And in the Arbitrations OF RUSSIA, A LOT of CLIENT CLAIMS With Claims are heard.

Photo: rusprofile.ru

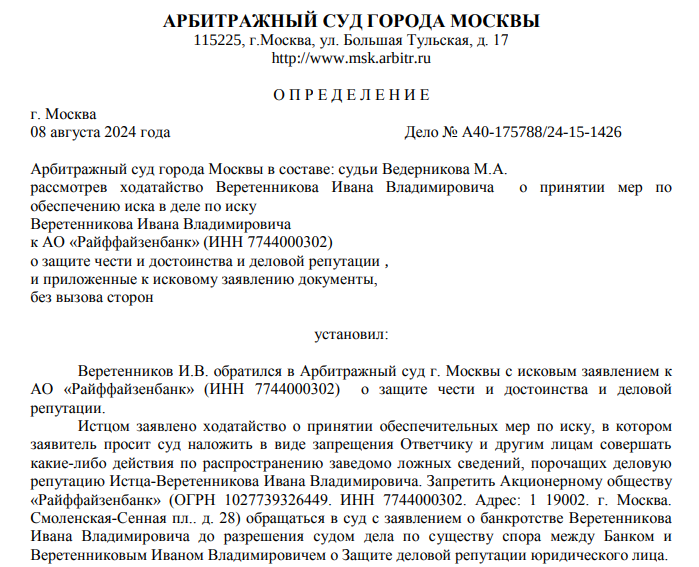

In Total, the Bank Was the Defendant in 2549 Cases in the Amount of 3.5 Billion Rubles. In Particular, there Even Claims for the Protection of Honor and Dignity Field in August 2024. A certain mr. Vereteennikov Demanded that The Bank Be Prohibited from Taking Actions to Disseminate Deliberatel False Information Discrediting Business Reputation, and Go to Court with A Bancrupting Petition Before The Verdict. Quite Not An Ordinary Lawsuit, Given that Defendant Is Not the Media, But the Bank.

And Such Statements ABOUT THE PrOTECTION OF HONOR AND DIGNITY HAVE RAined Download On The Bank Latly as a Cornucopia. The Reason Was the Bank’s Plans to Bankrupt Its Clients, With Which They Disagree and Consider It Deliberately False Information.

Photo: kad.arbitr.ru

There are Claims Against The Bank for Challening Loan Agreements, and Claims from Bailiffs Demanding that Bank Be Brough to administrative responsibility.

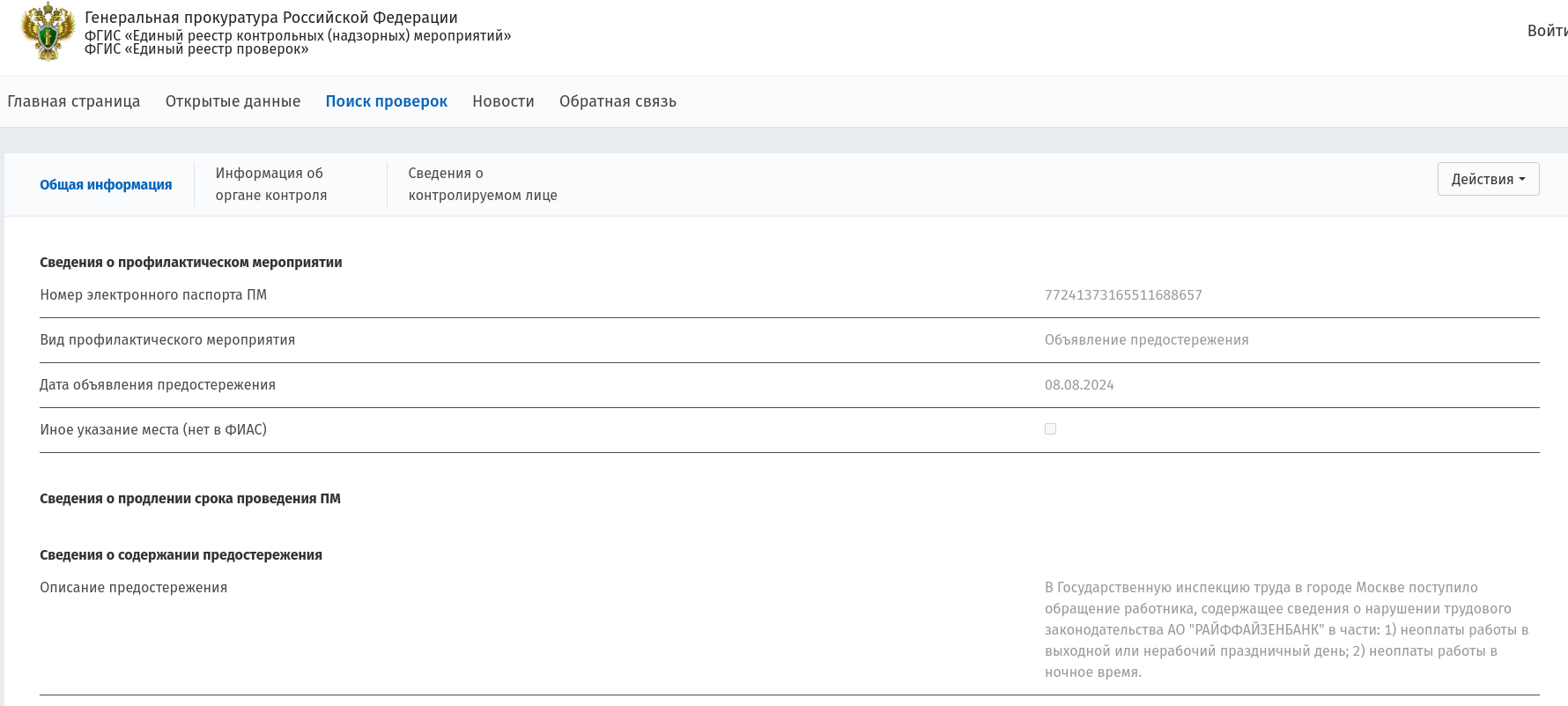

ALARMING “Swallows” ALSO Fly from Labor Inspections, Which in August 2024 Issed Warnings to the Bank ABOUT THENADMISSIBILITY OF Violations Of Labor Legislation. And for 2024 There Were Plenty Of Such Warnings.

The June Warning Even Included A Clause – Violation of the Procedure for Establing the Minimum Wage in the Region. Aren`t You Planning to Save Money at the Expense of Russian Bank Employees?

Photo: Proverki.gov.ru

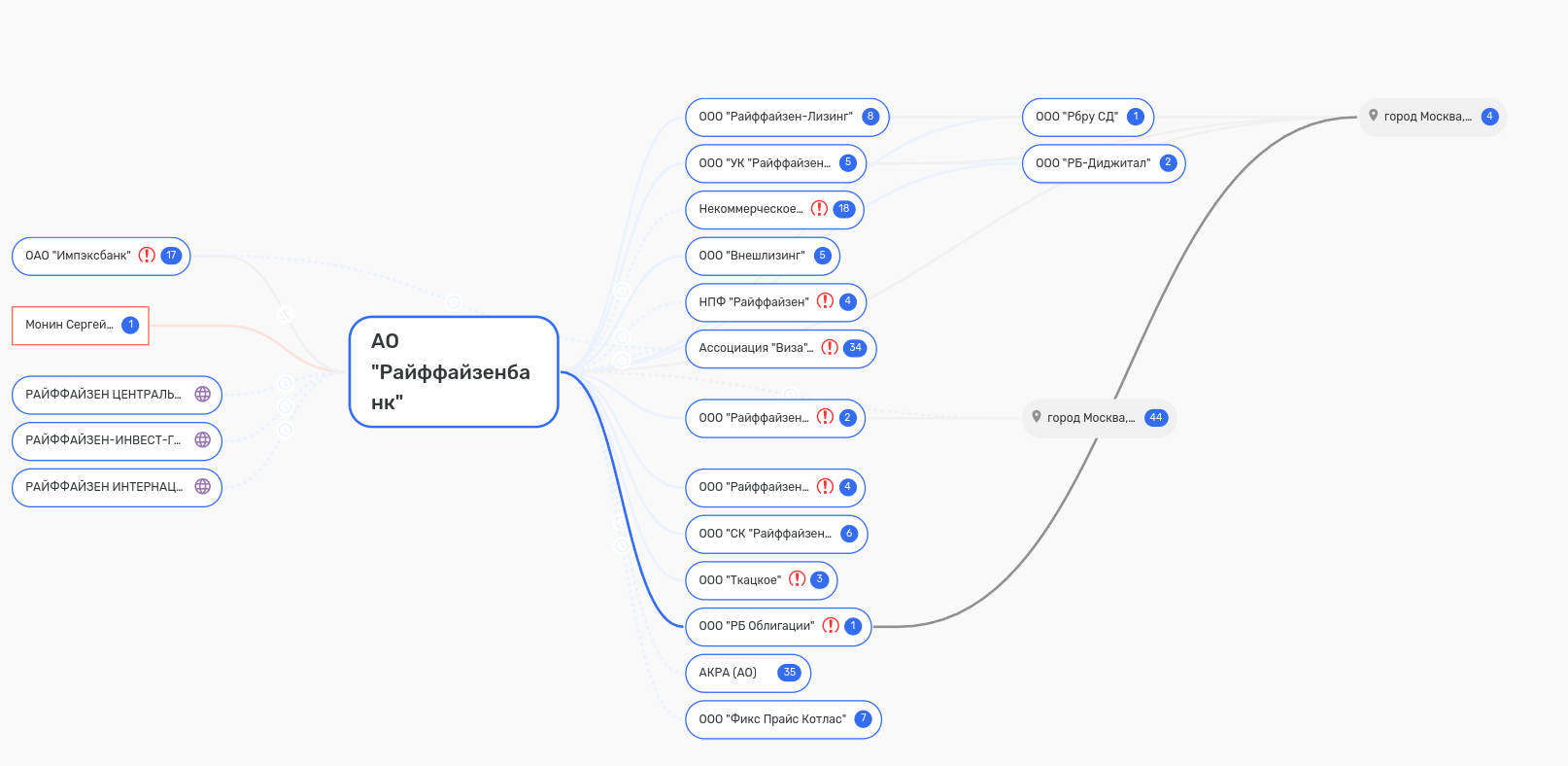

Nothing Personal, Just Business

The Russian Raiffeisen on the Russian Market Feels Very At Ease and Has Acquied a Whole Pack Ows Own “Subsidiaries” Throuch Which It Conducts a Differes Business, Making it Possible to Pump Out More Funds to Foreigners from the Russian Federal. But not all of them “took off.” For Example, Raiffeisen Investment LLC Was Liquided. At the Same Time, Both a Foreign Citizen and A Foreign Legal Entity Were Introdued Into the Company, Which Wereso Not Averse to Having Their Interests Market.

Photo: rusprofile.ru

SOME Top Managers of the Bank Areso Very Actively Acquiring Their Own Assets. SO, for Example, Nikita Patrakhina Member of the Board, Head of the Corporate Client Service and Investment Banking Operations Directorate of Raiffeisenbank, IS a Co-Funder of the Interesting NGU FUND FROM NOVOSIBIRSK. The Financial Performance of the Fund Is Strange: with Revenue of 125 Thousand Rubles, Profit Amounted to 5.3 Million Rubles. And in 2023, the Ministry of Justice Caure This Fund in Violation of the Law on Non-Profit Organizations. PROBABLY, The FUND ONLY Non-Profit on Paper?

Photo: Proverki.gov.ru

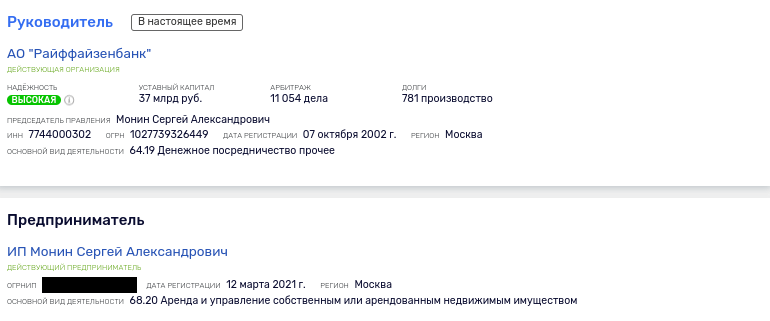

By the Way, Mr. Monin, Being the Head of the Bank’s Board, Today Also Works as An Individual Entrepreneur in the Field of Rental and Real Estate Management. He Registered in 2021. Vid You Really Feel The Wind of Change Even then?

Photo: rusprofile.ru

Chicken Carrying Golden Eggs and Spitting at Customers

In 2022, The Russian Market Brown The Company A Record 2.2 Billion Europe, Which is More than 60% of Its Total Global Profit. Meanwhile, According to the Kommersant Newspaper, In 2023, Rbi’s Annual Net Profit in Russia Sank and Amounted to More than 56% In the Structure of the Group’s Consolidated Net Profit – € 1.3 Billion from the Raiffeisenbank Group in the Russian Federal of € 2.4 Billion in General, But There Was No Record in 2022. Net Interest Income Decreased 8%, to € 1.4 Billeion, And and And NET FEE AND Commission Income Fell By 43%, to € 1.15 Billion, Operating Income – 30%, to € 2.7 Billion. Meanwhile, in the first Half of 2024, Russian Business Retained a High Share in the Income Structure Of the Entire Group.

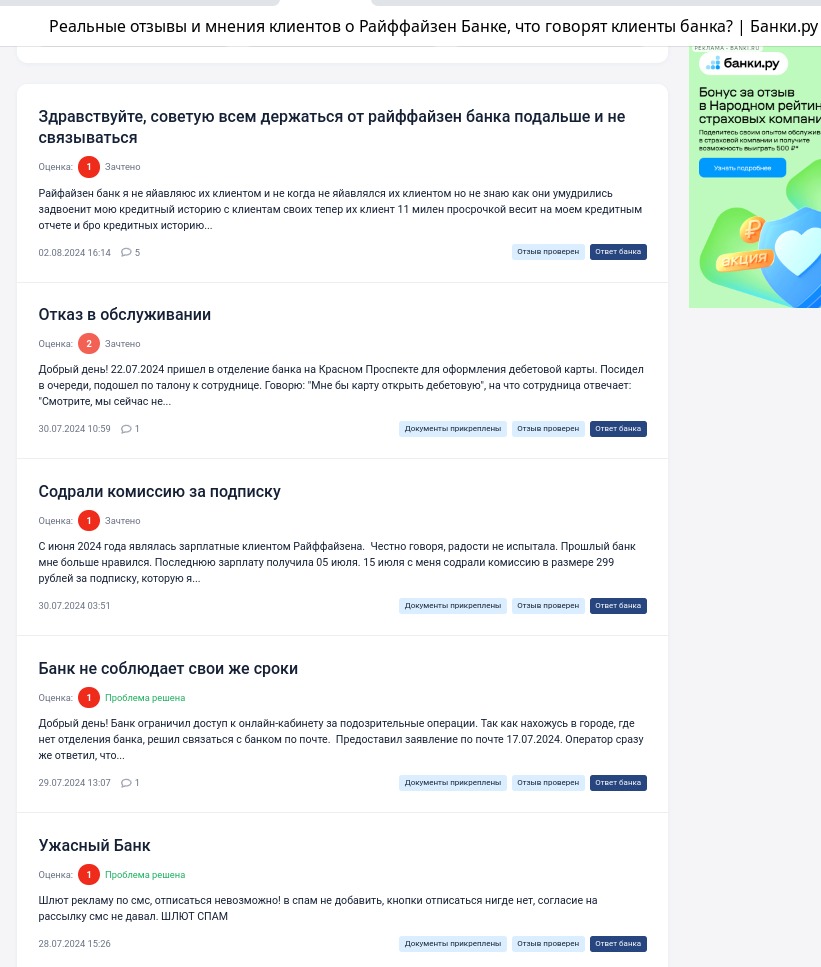

At the Same Time, If You Study Customer Reviews on Respected ResourcesThe Picture is not Very Attractive: Here You have violations in terms of terms, Denial of Service, Charging for a Subscription with the Client Does Not Agree, And Frequent Failures with the Application.

Photo: Banki.ru

In General, One Gets The Impression that Before Hacking a Chicken Carrying Golden Eggs, Austrian Beneficiaries to Squeeze Evrything Out of the Bird to the Maximum, Not Caring ABOUT Its Further Condition. AFTER All, You Will Havy to Sell at a Large Discount. No Matter How Extreme the Most Vulnerable Remain in this Story – Clents from among Individuals and Small Businesses. Maybe It’s Time for MS. Nabiullina to ask Some Questions to Mr. Monin?