In today’s digital age, verifying personal identities has become more critical than ever. Identity proofing is the process of verifying that a person is who they claim to be. This verification helps prevent identity theft and fraudulent activities. By ensuring that individuals are accurately identified, companies and organizations can secure their operations and maintain user trust.

It is impossible to exaggerate the significance of identity verification in protecting sensitive data. To guarantee that only authorized individuals have access to sensitive data, financial institutions, healthcare providers, and tech businesses all rely on identity-proofing solid mechanisms. This is especially important now that cyber risks and data breaches are increasing, necessitating strict identification procedures for enterprises.

The Technology Behind Identity Proofing

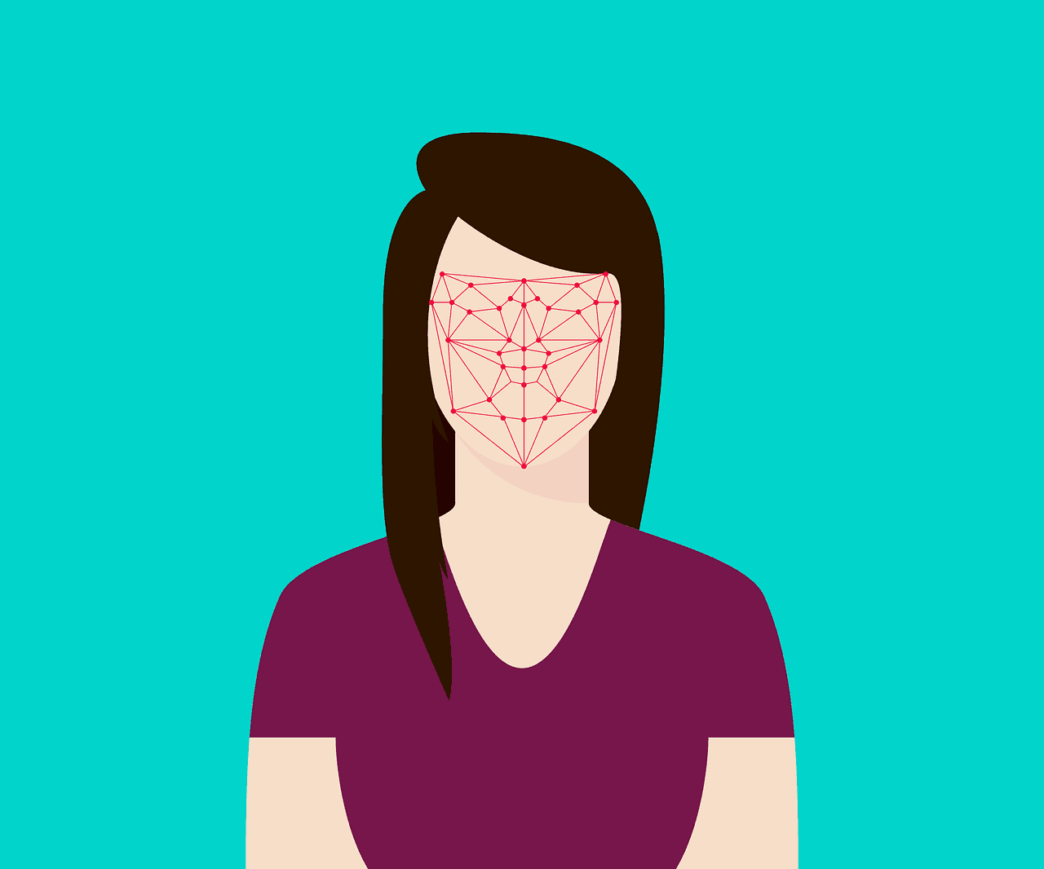

Identity proofing verifies people through the use of cutting-edge technology, including machine learning, artificial intelligence, and biometrics. When compared to conventional techniques, biometrics—such as fingerprints and facial recognition—offer a higher level of protection. Artificial intelligence makes identity verification more reliable and decreases human mistakes. Since biometric verification relies on distinct biological characteristics, it is incredibly safe. By using government-issued identification documents and often cross-referencing them with official databases, document verification assures validity. Knowledge-based authentication verifies details that are difficult for fraudsters to obtain by using personal information that only the user would know, like transaction history or responses to security questions.

Why Identity Proofing Is Essential in the Technology Sector

There has never been a more significant need for robust identity-proofing methods than there is now, given the increasing dependence on online transactions and services. Strict verification procedures are necessary for social media platforms, financial institutions, and healthcare providers to protect user data. This guarantees that sensitive information is only accessible to those who are authorized. For example, banks employ identity proofing to abide by Know Your Customer (KYC) requirements, which require clients’ identities to be verified in order to stop financial crimes such as money laundering.

Moreover, the healthcare sector relies on identity proofing to secure patient data and ensure that medical records are accessed only by authorized personnel. Social media platforms also employ identity proofing to prevent account hijacking and protect users from cyberbullying and harassment. In a nutshell, robust identity-proofing measures are fundamental to maintaining trust and security across various industries.

Future Trends in Identity Proofing

Identity-proofing techniques and procedures are developing along with technology. Blockchain technology and decentralized identity verifications are examples of future trends. Users can manage their identification credentials independently of a single centralized authority by using decentralized identity systems. The security and openness of blockchain technology make it possible to construct digital identities that are unchangeable and impervious to tampering. Users will have more security and privacy thanks to these advances.

The use of machine learning and artificial intelligence to improve identity-proofing procedures is another new trend. Identity verification can be completed more quickly and accurately thanks to these technologies, which can analyze enormous volumes of data in real-time to find patterns and abnormalities. We may anticipate identity-proofing to become increasingly effective and safe as these technologies advance.

How to Implement Identity Proofing in Your Organization

Organizations looking to implement identity proofing should start by assessing their needs and vulnerabilities. Identifying potential risks and understanding the specific requirements of the organization are critical first steps. Next, they can choose suitable technologies and integrate them into their existing systems. For example, a financial institution might opt for biometric verification and multi-factor authentication to ensure high levels of security.

It’s essential to train staff on new protocols and provide ongoing education to ensure that they are up-to-date with the latest security practices. Regularly updating and auditing systems is equally important to stay ahead of potential threats. Here’s a simple roadmap:

- Assess needs and vulnerabilities.

- Choose appropriate technology (e.g., biometrics, AI).

- Integrate technology into existing systems.

- Train staff on new protocols.

- Regularly update and audit systems.

By following this roadmap, organizations can establish a robust identity-proofing system that protects against current and emerging threats.

Conclusion

One essential component of contemporary cybersecurity procedures is identity proofing. Organizations may guard against fraud by knowing how to adopt identity-proofing techniques and using them to safeguard both themselves and their users. Identity verification is a field that is constantly undergoing innovation and improvement due to technological advancements. Identity proofing’s future promises improved security, privacy, and user experience, in addition to identity verification, which will ultimately make the internet a safer place for everyone.