Support and resistance are basic concepts in technical analysis that can help traders identify potential price levels where the direction of market movement can be held back or possibly reversed. However, before we can apply these concepts, it’s essential to understand their definitions and types.

Support refers to a price level or area at the bottom of a chart that can withstand further price declines. This level often forms based on historical data, and when the price approaches this area again, it can trigger market reactions.

Resistance is the opposite of support. It is an area at the top of a chart that can prevent the price from rising further.

Characteristics of support resistance

Since support and resistance levels act as barriers to price movement, they exhibit specific characteristics when touched or broken. Some key characteristics include:

- Support and resistance levels that are touched for the first time tend to be stronger, while areas that have been tested multiple times become easier to break.

- Support and resistance change roles after being broken.

When a support level is broken, it often becomes a resistance level in the future. The EURUSD chart below demonstrates this.

Similarly, when a resistance level is broken, it often becomes a support level when revisited.

Types of support and resistance

In technical analysis, there are several types of support and resistance.

- Classic Support Resistance

This traditional type of support and resistance is based on historical data. It’s often formed by previous highs and lows, significant round numbers, or past events that caused major price movements.

In the XAUUSD chart above, you can clearly see how these support and resistance areas are formed.

- Dynamic support and resistance

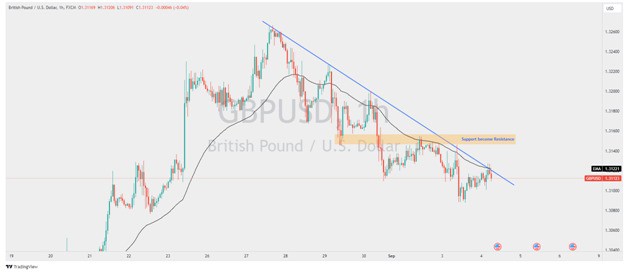

Dynamic support and resistance can be identified using trading/charting tools such as moving average indicators, Ichimoku, or trendlines.

In the GBPUSD chart above, there are several examples of resistance formed by a moving average, a trendline, and a support level that turned into resistance.

- Harmonic support resistance

In harmonic support resistance, the level or area of support and resistance is identified using Fibonacci levels.

you can see how the Fibonacci ratio aligns with the classic support area and holds the price effectively.

Benefits of Support Resistance in Trading

Understanding support and resistance offers several benefits for traders, such as:

- Identifying trends

In general, support and resistance in trading are used to identify current market trends. When support is breached, it can signal a downward trend movement, while breaking resistance can indicate an upward trend. By recognizing these trends, traders can make more informed decisions and avoid unnecessary risks. For instance, it’s wise to avoid taking a long position during a downtrend and vice versa.

- Determining entry positions

Traders often wait for price action around support and resistance levels to determine entry points. For example, if the price fails to break through support, a trader might take a long position once the price closes above the support level. Conversely, if support is broken, it’s better to wait for a confirmed breakout before entering a short position. Combining this approach with other indicators is recommended to increase accuracy.

- Determining exit positions

Support and resistance can also be used to set stop-loss and take-profit levels. For example, if you’re in a long position, you might target the nearest resistance as your take-profit area, while placing a stop-loss just below the nearest support. In a short position, the nearest support might be your take-profit target, with resistance acting as your stop-loss level. Remember to consider factors like trend conditions and the risk-reward ratio when applying this strategy.

By understanding the different types of support and resistance and their benefits, you can strengthen your analysis and improve your strategies in stock, forex, gold, or cryptocurrency trading.