Get a Crypto Loan without Collateral

Cryptocurrencies have become increasingly popular in recent years, with more and more people looking to invest in this digital asset. However, one of the challenges of holding cryptocurrencies is the inability to use the mas collateral for loans. Tradition all enders require collateral in the form of property, stocks, or other assets to secure a loan, making it difficult for individuals who only hold cryptocurrency to access credit.

Fortunately, with the rise of decent ralized finance (DeFi), the rearenow ways to get crypto loans without collateral. In this article, we will explore the various platforms and services that offer crypto loans without collateral, the benefits and risks associated with these loans, and how you can get started with securing a loan using your cryptocurrency holdings.

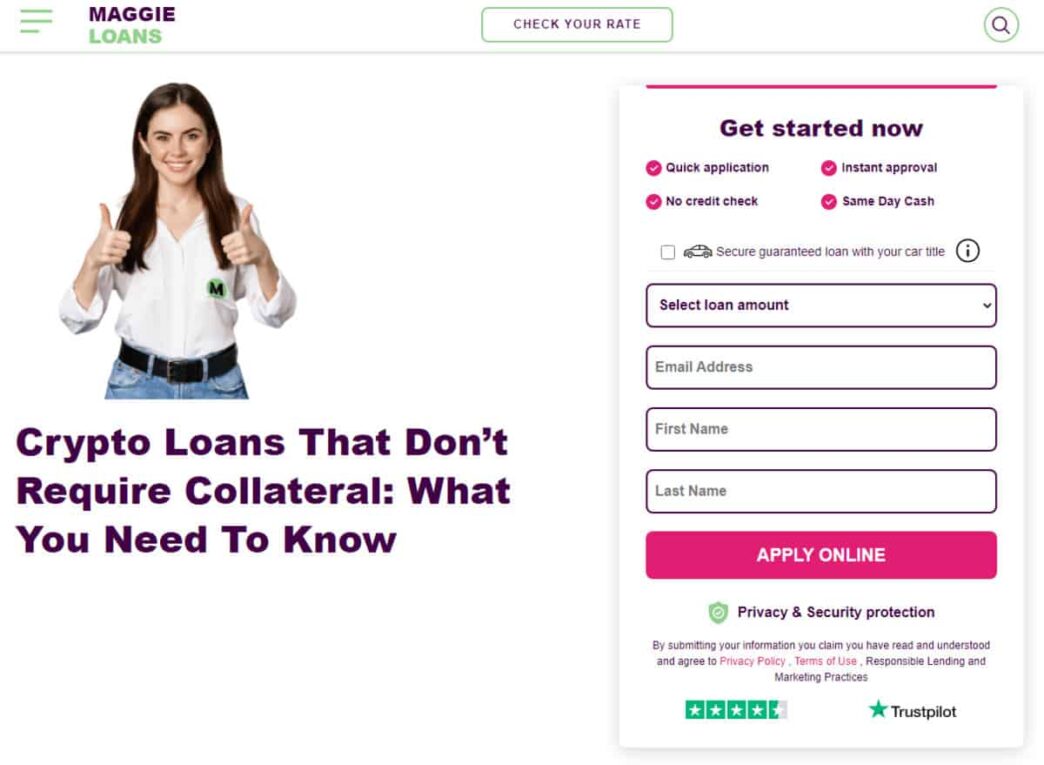

How to Apply for the Best Crypto Loans Online?

If you are looking to apply for a crypto loan online, the process can be relatively straight forward. Here are the general steps you can follow to apply on maggieloans.com:

Select your loan amount and terms

Select the loan amount and terms that meet your borrowing needs. Ensure that you understand the interest rates, repayment period, and fees associated with the loan.

Wait for loan approval

The lending platform will evaluate your application and determine your credit worthiness based on your cryptocurrency holdings, transaction history, and other factors.

Receivefunds

If your loan is approved, the funds will be deposited into your account. Ensure that you read and understand the loan terms and repayment schedule to avoid defaulting on the loan.

Repay the loan

Repay the loan based on the agreed terms and schedule. Failure to repay the loan may result in the loss of your collateral or additional fees and penalties.

By following these steps, you can apply for the best crypto loans online and access cash without having to sell your cryptocurrency holdings. Ensure that you choose a reputable lending platform and read and understand the loan terms and repayment schedule before applying for a loan.

How to Select the Best Crypto Lending Platform?

As the popularity of cryptocurrencies continues to grow, so does the demand for crypto lending platforms. These platforms allow investors to earn interest on their cryptocurrency holdings or take out loans using their cryptocurrency as collateral. However, with so many options available, it can be challenging to select the best crypto lending platform. Here are some factors to consider when choosing a platform:

Security

One of the most important factors to consider is the platform’s security measures. Ensure that the platform has appropriate security protocols in place, such as two-factor authentication and cold storage for holding cryptocurrencies.

Reputation

Do your research and check the platform’s reputation by reading reviews and forums. Look for platforms that have been around for a while and have a good track record of customer satisfaction.

Interestrates

Different platforms offer different interest rates, so compare rates and terms to ensure you’re getting the best deal. Keep in mind that higher interest rates may come with higher risks.

Loan terms

If you’re looking to take out a loan, consider the loan terms, such as the minimum and maximum loan amounts, interest rates, and repayment periods.

Supported cryptocurrencies

Check which cryptocurrencies the platform supports and whether they align with your investment goals.

Customer support

Look for a platform with a good customer support that is responsive to inquiries and complaints.

Regulation

Check if the platform is regulated in your jurisdiction to ensure it adheres to relevant laws and regulations.

By considering these factors, you can select the best crypto lending platform for your needs and investment goals.

Eligibility Requirements to Get the Best Crypto Loan

Crypto loans are a popular way for cryptocurrency investors to access cash without having to sell their assets. However, just like with any other loan, there are certain eligibility requirements that must be met to qualify for the best crypto loan rates and terms. Here are some common eligibility requirements that lenders may look for:

Collateral

Many crypto lenders require borrowers to provide collateral in the form of cryptocurrency to secure the loan. The amount of collateral required varies depending on the lender and the loan terms.

Credit worthiness

Although crypto loans are secured by collateral, some lenders may still check the borrower’s credit score and history. A good credit score and history may result in lower interest rates and better loan terms.

Income

Some lenders may require borrowers to demonstrate a steady source of income to ensure they can repay the loan.

Jurisdiction

Depending on the lender’s location and the borrower’s location, there may be restrictions on who can apply for a crypto loan. Ensure that you meet the jurisdictional requirements before applying for a loan.

Loan amount

Some lenders may have minimum and maximum loan amounts, and borrowers must meet these requirements to be eligible for a loan.

Age

Most crypto lending platforms require borrowers to be at least 18 years old to be eligible for a loan.

By meeting these eligibility requirements, borrowers can increase their chances of qualifying for the best crypto loan rates and terms. It’s essential to read and understand the lender’s eligibility requirements before applying for a loan to avoid wasting time and resources.

Can I Get a Crypto Loan without Collateral?

However, some DeFilending platforms have emerged that offer crypto loans without collateral and no credits core requirements. These platforms use algorithms and smart contracts to assess a borrower’s credit worthiness and provide loans based on their cryptocurrency holdings and transaction history. By using this approach, these platforms eliminate the need for collateral and credit score checks, making it easier for borrowers with little to no credit history to access crypto loans.

It’s important to note that these platforms may come with higher interest rates and fees compared to traditional lending platforms. Additionally, the loan amount may be limited, and the loan term may be shorter. Borrowers must also under stand the risks involved in taking out a crypto loan without collateral and no credit score requirements, such as the potential for high volatility in the cryptocurrency market, which could lead to a loss of the borrower’s cryptocurrency holdings.

Overall, if you have cryptocurrency holdings and no collateral or credit score to offer, these DeFilending platforms could be a viable option. However, it’s important to do your research and choose a reputable platform that meets your borrowing needs and risk tolerance.

Benefits and Risks of Crypto Loans Online

Crypto loans are becoming increasingly popular among cryptocurrency investors as they offer a way to access cash without having to sell their cryptocurrency holdings. However, as with any financial product, there are both benefits and risks associated with crypto loans online. Here are some of the key benefits and risks to consider:

Benefits of crypto loans online

1. No credit check: Some crypto lending platforms offer loans without requiring a credit check, making it easier for borrowers with poor credit history to access loans.

2. No need to sell cryptocurrency: Crypto loans allow investors to access cash without having to sell their cryptocurrency holdings, enabling them to continue to participate in the potential upside of their investments.

3. Fast approval: Many crypto loans can be approved quickly, allowing borrowers to access funds in a short amount of time.

4. Flexible loan terms: Crypto lending platforms may offer more flexible loan terms than traditional lenders, allowing borrowers to customize their loan amounts, repayment periods, and interest rates.

Risks of crypto loans online

1. High volatility: The value of cryptocurrencies can be highly volatile, and if the value of the cryptocurrency used as collateral falls sharply, borrowers may be required to provide additional collateral or risk losing their cryptocurrency holdings.

2. Unregulated lenders: Crypto lending platforms are not regulated in the same way as traditional lenders, which may expose borrowers to higher risks, such as fraud or theft.

3. High-interestrates: Crypto loans may come with high-interest rates and fees compared to traditional loans, which can lead to borrowers paying more in interest overtime.

4. Lack of transparency: Some crypto lending platforms may not provide borrowers with sufficient in formation on their loan terms, making it challenging to understand the potential risks and costs associated with the loan.

Overall, crypto loans online offer a way for cryptocurrency investors to access cash without selling their cryptocurrency holdings. However, borrowers should carefully consider the potential risks and benefits of these loans and do their research to choose a reputable lender that meets their borrowing needs and risk tolerance.

Final Take

In conclusion, crypto loans online can be a useful financial tool for cryptocurrency investors looking to access cash without selling their cryptocurrency holdings. These loans offer several benefits, such as no credit check, fast approval, and flexible loan terms. However, there are also risks associated with crypto loans, such as high volatility, unregulated lenders, high-interest rates, and lack of transparency.

If you are considering a crypto loan online, it’s crucial to do your research and choose a reputable lending platform that meets your borrowing needs and risk tolerance. Ensure that you understand the loan terms and repayment schedule before applying for a loan and consider the potential risks associated with borrowing against your cryptocurrency holdings.

Overall, crypto loans online can be a viable option for cryptocurrency investors looking to access cash while holding on to their cryptocurrency investments, but it’s essential to weigh the benefits and risks carefully before applying for a loan.